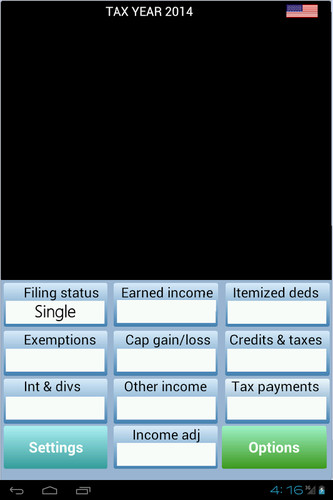

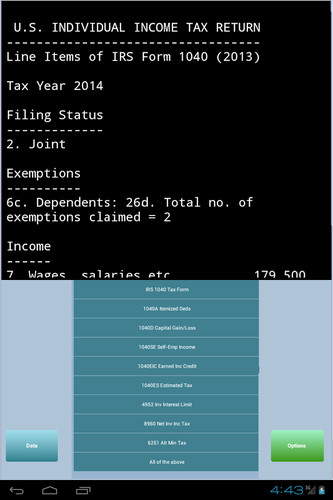

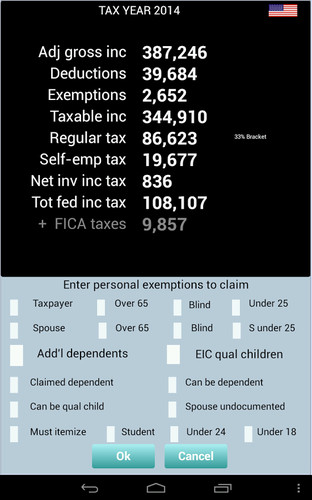

KEY ACTIVE FEATURES● New tax year 2015● US income tax computations for 2015, 2014 & 2013.● Items for tax years 2015 and 2014 include- - Additional Medicare Tax for Self-employed income - High earner qualified dividend & capital gains tax - Net investment income tax (Healthcare tax) - Itemized deductions with threshold & phase-out - Personal exemptions with threshold & phase-out - Modified Alternative Minimum Tax (AMT) calculations - Modified Earned Income Credit (EIC) calculations● Quarterly Estimated Tax computations, report & IRS 1040ES form support*● Automatic selection of applicable tax computations● Automatic check for AMT applicability and analysis● Computes Earned Income Credit● Verify the adequacy of estimated tax payments● Analyze impact of specific deductions● Supported with details in terms of IRS tax forms*● Summary or detailed data entry options*● Side by side comparison of alternative scenarios for what-if analysis*● Effective tool for pre-tax return analysis● Contains computations for tax years 2015, 2014 and 2013● Ability to email reports*● Enhanced data entry*● Ability to load & save plans*● Pie chart & multiple reports*● Tax calculations include- - Regular income tax - Tax based on QDCG worksheet - Self-employment taxes - Net Investment Income Tax - Alternative minimum tax - Lump-sum distribution tax - Earned Income Credit● Automatic limitation of maximum amounts allowed for - - Medical expenses - Investment interest deduction - Charitable contributions - Unreimbursed business expenses - Casualty & theft losses - Student loan interest deduction - Tuition & fees deduction

TaxMode is a quick and efficient app for income tax planning. It provides an easy way to compute taxes and perform what-if analysis. It contains detailed implementation of US tax laws for 2014 and earlier years. TaxMode’s capabilities can satisfy almost any level of need for tax computation, planning and analysis.

This app can be a valuable tool for professionals and nonprofessionals alike. For a tax professional it will enhance your analytical ability, improve your day to day productivity and make tax planning more efficient. For an independent individual, it provides an easy to use tool to analyze the tax impact of a transaction in terms of taxes saved or increase in tax liability, calculate a quick year-end tax estimate, perform a pre-tax-return-filing analysis, or review the impact of any other tax related investment decision;

TaxMode can be used with confidence. It is created and supported by Sawhney Systems, a leading developer of personal financial and tax planning software. At Sawhney we have been providing software and related support services to the financial planning professionals since 1976. Our leading software package ExecPlan (www.execplan.com) was the first integrated financial planning software available commercially in USA and the most widely used professional software over past three decades. ExecPlan Express (www.execplanexpress.com) is our latest financial planning software designed to be a crossover product to fulfill diverse planning needs of a professional planner as well as a motivated individual involved in retirement or comprehensive financial and tax planning at a very reasonable price.

We hope you have a productive and satisfying experience with this app and delight us by reviewing TaxMode Pro at Google Play.

Please let us know any thoughts or suggestions you may have while using TaxMode that will help us improve its functionality. Similarly, please write us at support@taxmode.net if you discover a computational error or have questions on a specific calculation. Thank you.

*Indicates premium functions